You do everything you can to create a relaxing and comfortable environment for your clients, including providing calming sounds, soft lights, and warm sheets. But what do you do when an accident or injury interrupts the peace?

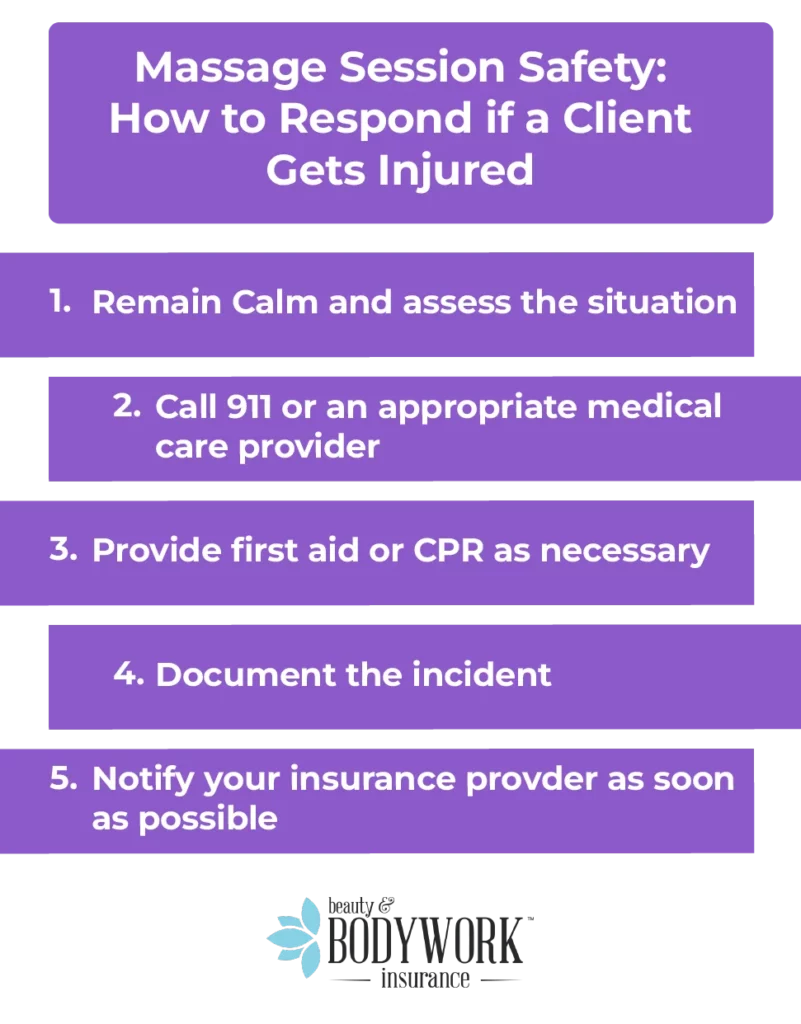

When a Client Is Injured During a Massage: Your Action Plan

Massage client injuries can vary in severity, so you need to be prepared for whatever incidents arise. Follow these best practices to minimize risks for you and your clients..

Deep breath in. Relax. You got this.

1. Remain Calm and Assess the Situation

As they say in CPR training, “What’s worse than one victim? Two victims.”

This is why you should always calmly assess the situation first to make sure the immediate scene or surroundings are safe before you go in to help others. You need to make sure that whatever hurt them will not hurt you, too. Of course, if a client is injured during a massage session with you, the area is most likely safe. But it’s important to check!

The initial assessment should only take a second. Then, you can check on your client to make sure they are safe, meaning they are not actively choking or in immediate danger of getting even more hurt.

2. Get Medical Assistance (Call 911)

If the injury is severe or beyond your ability to handle, call 911 immediately. If the client is unconscious, not breathing, or bleeding significantly, you should call 911 right away.

If you work in a spa or office, you’ll likely have an emergency action plan in place. If you do, follow that procedure.

What if you’re unsure about the severity of an injury? Let’s say a client trips on their way into your room and they hit their head on a cabinet while trying to keep themselves from falling.

The client could insist they’re okay, or you may notice their balance is a little off. Even if their immediate health does not appear to be in jeopardy, you should still call the paramedics to be safe. The client can always refuse treatment when the squad arrives, and you’ve taken the proper steps to ensure their safety.

3. Perform the Appropriate First Aid

Perform any necessary first aid that is within your scope of practice. This could be something as small as an adhesive bandage or a bag of ice. If you work out of your home or your clients’ homes, keep a basic first aid kit in your equipment bag.

In the event your client falls unconscious and stops breathing, follow your CPR training. If you’re alone, call 911 immediately on speaker phone while beginning CPR. If there are others with you, you can delegate calling 911 to them while you start CPR.

Regardless of severity, take your client’s concerns seriously and communicate clearly. Set expectations of how you will handle the situation. Empathy and transparency go a long way in resolving many (non-emergency) issues.

Pro Tip: Keep your CPR/AED and First Aid certifications current to maintain your massage therapist license.

4. Document the Incident

If you work in a spa or studio, you’ll likely have an incident report or paperwork to fill out for the facility, as well as yourself. If you’re a mobile massage therapist or work out of your home, you still need to document any and all client injuries.

If you’re a mobile or from-home massage therapist, you should have your own incident report documents on hand. You may make your own with the help of a lawyer to ensure all of your bases are covered.

Keep a detailed record of the entire event, including:

- The client’s information (name, relevant history, etc.)

- Take photos of the injury when possible and appropriate

- The date, time, and injury itself

- The client’s condition before and after the injury

- How it happened

- Where it happened (lobby, massage room, etc.)

- What events occurred leading up to and following the injury

- Names and contact information of witnesses

- Anything else that seems appropriate or notable about the incident

Pro Tip: The more meticulous the notes, the better prepared you’ll be for possible liability claims or lawsuits.

5. Report the Incident to Your Insurance

Report the incident right away to your insurance company. Early, up-front notifications help us resolve liability claims more efficiently, which is best for you and your client!

Injury claims can become very expensive, very quickly. Be prepared and protect yourself from the costs of client injury claims with professional liability insurance for massage therapists.

Massage therapy liability insurance is designed to cover your bodywork services. If a client does suffer an injury because of your work, your insurance is there to help you handle it so you can keep helping your customers with confidence and peace of mind.

Frequently Asked Questions About Massage Client Injury Protocol

Can I Be Held Liable if a Client Is Injured?

Yes. If a massage client is injured during your service, you can be held liable for those injuries. The client could also sue the company or clinic where you work.

Even if your services are not the direct cause of an injury — say a client trips and falls — you may still be found liable or partially liable. If so, you’ll be responsible for paying the client’s medical bills. Massage therapy liability insurance is there to help you cover those costs.

Run your own spa? You can be held liable for client injuries caused by your team. BBI offers blanket coverage for your business and all the LMTs who work there under one easy policy. Check out BBI Spa Insurance.

How Can I Reduce the Risk of Injuring a Client?

- Complete thorough massage intake forms

- Communicate clearly

- Create a clean and safe environment

- Avoid services or treatment beyond your scope of practice

- Be prepared for emergencies

Learn more about how to prevent massage therapy injuries.