There’s a lot of legal jargon on insurance documents, so it’s reasonable not to feel confident in your understanding of your liability insurance certificate. Let us help ease any tension by unraveling these jumbles of jargon-knots.

What Is a COI for Massage Therapists?

COI stands for Certificate of Insurance. It acts as proof that you have liability insurance for your massage therapist business. It’s like your ID card for your health or car insurance, but for your business.

Sometimes you’ll also hear or read about an ACORD COI, or just an ACORD. ACORD stands for Association for Cooperative Operations Research and Development. It’s the same thing as a certificate of insurance, it’s just a standardized version of the form created by the ACORD organization.

COI = ACORD = ACORD COI = Certificate of Insurance = proof of your massage therapist liability insurance.

Do Massage Therapists Need a COI?

Yes. You’ll likely be asked to provide a COI or proof of insurance many times throughout your massage therapy career. Why?

- Some states include liability insurance as one of your licensing requirements

- Landlords of the spaces you rent or lease require proof of insurance

- Employers might ask for proof of insurance if you’re hired as an independent contractor instead of an employee

- Event organizers with expos, festivals, and similar things typically require proof of insurance

- Business partners and other collaborators may want to confirm you have your own insurance

- Clients might ask you to prove that you’re insured

What Information Is on a Certificate of Insurance?

COIs provide the basic information about your insurance coverage, like:

- The name of the insured person and the name of the insurance company

- The types of insurance purchased

- The limits of coverages

- Policy start and end dates

How to Read a COI

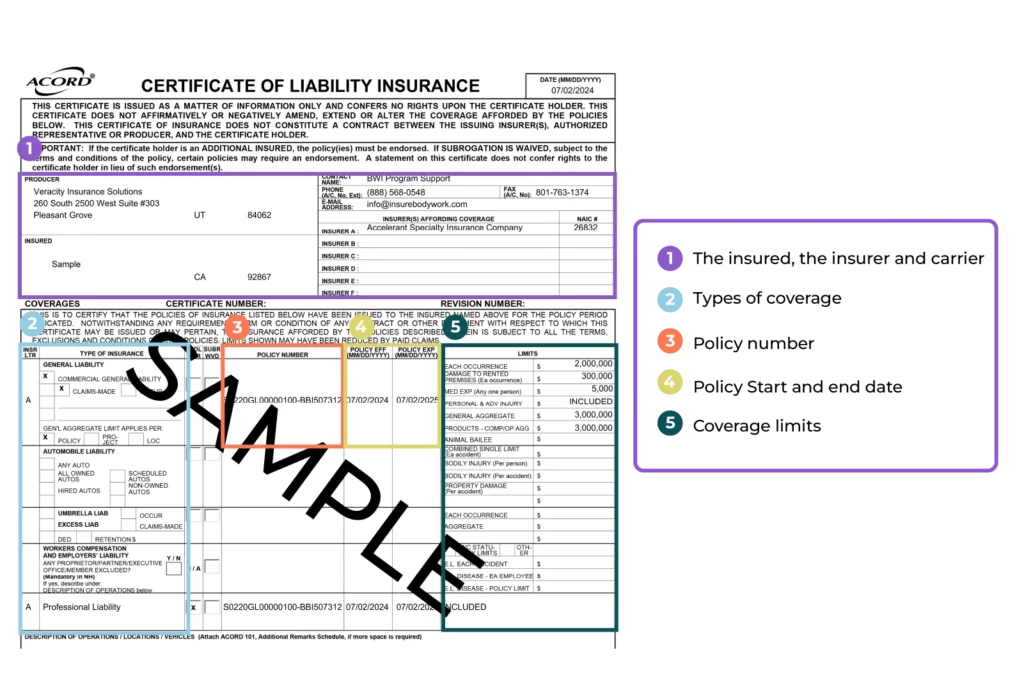

Here’s an example of a real certificate of insurance for reference.

Let’s start from the top. The first two boxes of text basically state that this document is a summary of your insurance policy and is for informational purposes only. It is proof you have insurance and has no other power, authority, or purpose.

Section One

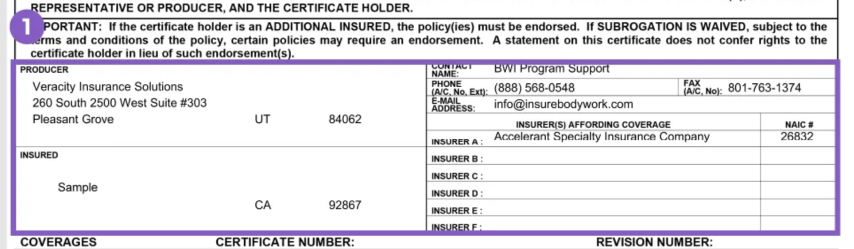

The first section outlined in purple lists the insured, the insurance company, and the insurance carrier.

- Producer: The insurance company/provider — that’s us! Veracity Insurance is like the parent company for BBI (which is why you see that name and not Beauty and Bodywork Insurance).

- Insured: That’s you! You’ll see your name or your business name here.

- Insurer Affording Coverage: This is the company known as the “carrier.” This is a separate company from the producer (us), but one that we partner with closely. If you have to file a claim, they help handle validating, accepting or denying, and eventually paying for that claim.

Section Two

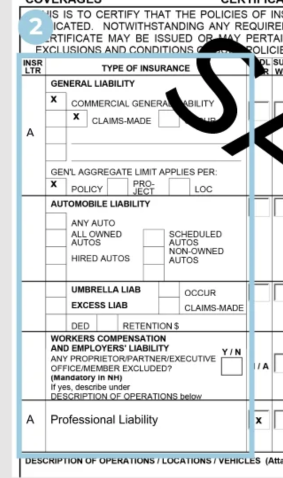

Section two, outlined in blue, shows what kinds of coverages you have. The “x” means you have that type of insurance.

At the top, you have boxes for “Commercial General Liability,” “Claims-Made vs Occur” (short for Occurrence), and “General Aggregate Limit Applies Per.”

- Commercial General Liability: Insurance that covers injuries or damages to others, like your clients, their personal belongings, or a space you rent. An “x” in this box means you have general liability coverage.

- Claims-Made and Occurrence*: The two types of policies that dictate how claims are filed.

- Claims-Made: If you have an “x” in this box, you have a claims-made policy. If you need to file a claim, you must do so within a specific time frame, and your policy must be active. So if someone was injured by one of your massages but doesn’t report it until six months after your policy expired, it would not be covered.

- Occurrence: If you have an “x” here, you have an occurrence-based policy. With this kind of policy, you can report and be covered for a claim any time, as long as the incident itself happened during your policy period. In this case, if someone was injured by your massage and doesn’t report a claim until six months after your policy expired, they would still be covered.

- General Aggregate Limit Applies Per: This describes the timeframe for your coverage. An “x” in the “Policy” box here means your total coverage amount is good for a specific date range, which is outlined in section four.

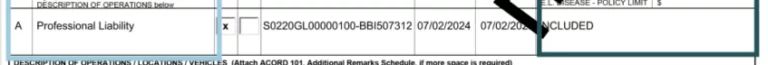

At the bottom of this section is Professional Liability. BBI automatically includes this coverage in all our massage therapist liability policies! So you should see an “x” and “included” in the sections connected to Professional Liability.

*All new policies purchased after July 1, 2024 include occurrence-based coverage. Policies purchased before this date are eligible for occurrence-based coverage upon renewal.

- Professional Liability: Insurance for claims related to physical or financial harm your services or advice cause to a client later, aka not during the massage or treatment itself. You might also see this coverage called Errors & Omissions Insurance and/or E&O Insurance.

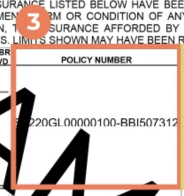

Section Three

Your policy number! You’ll need this number if you need to file a claim.

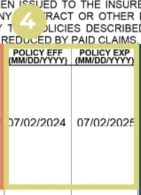

Section Four

This is your policy period, and the dates depend on your chosen start date. In this example, the massage therapist’s insurance starts on July 7, 2024 and ends July 7, 2025.

Policy Eff: Policy effective date, aka the first day you have coverage.

Policy Exp: Policy expiration date, aka the last day you have coverage.

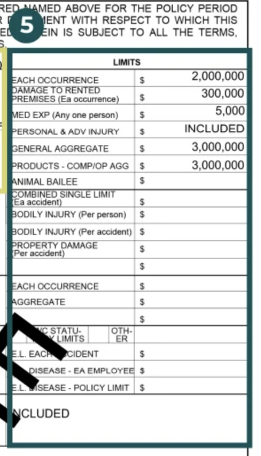

Section Five

This section outlines the dollar amounts of all your coverages.

“Limits” or “limits of liability” means the maximum dollar amount your insurance will pay during one policy period.

- Occurrence Limit: The max monetary amount your insurance will pay for each individual claim or incident.

- Aggregate Limit: The max total amount your insurance will pay during a whole policy period.

In this example, your insurance would pay a maximum $3 million during your policy year. So it will not pay anything over $3 million even if you have multiple claims that add up to more than that amount.

Learn more details about what massage therapist liability insurance covers.

What to Check on Your Massage Therapist COI

The most important parts of your certificate of insurance to double-check are:

- Your name or business name

- The policy dates

- Your coverage types and amounts

Make sure all names, dates, and addresses are correct and contain no typos or misspellings. If something is spelled wrong on your COI, it’s probably misspelled on your actual policy (contact customer service to get it fixed).

Double-check the coverage amounts in the “Limits” section to ensure you have the coverage you’re supposed to. Landlords, state licensing boards, and others who need a copy of this document will look at those numbers to make sure they meet minimum requirements.

How Do I Get My Massage Therapist Certificate of Insurance?

BBI makes getting your COI easy with two simple steps.

- Log into your user dashboard.

- Click “Download Certificate.”

You’ll then have access to your certificate and view it as needed or send it to whatever parties ask for it.

Frequently Asked Questions About COIs

What Is the Difference Between a COI and an Insurance Policy?

A COI is a snapshot of your insurance policy. It only shows proof that you have insurance.

An insurance policy outlines the kinds of insurance you have, terms and regulations, exclusions, and all the other regulatory information. The policy has many pages of information, while the COI has one or two.

What Does “Additional Insured” Mean?

An additional insured is another person, business, or entity that could be held responsible for accidents or injuries you cause.

Additional insureds are often employers, landlords, spa managers, and others. They cannot be friends, family members, your employees, or other therapists.

You can add additional insureds to your policy at any time. You can access a COI with their information included as soon as you add them to your policy.

Is a COI Required to Legally Practice Massage Therapy?

Short answer: No. A COI is just a document that shows you have insurance. Liability insurance itself, though, is required.