Buying insurance — especially when you’d rather be helping clients relax — is not the most fun part of being a massage therapist. However, it’s an essential step in protecting your bodywork business so you can focus on doing what you love.

While it’s tempting to purchase the first policy that pops up in your search, rushing the decision can leave you underinsured or exposed to risks. A little extra research now can save you a lot of stress later!

Here are some of the most common massage therapy insurance mistakes and how to avoid them.

1. Underestimating Risk

The first mistake massage therapists make is underestimating the financial toll liability risks can take on their businesses and forgoing massage insurance coverage altogether.

Taking an “I’m too careful to ever need insurance” approach leaves the future of your business to chance. Accidents like allergic reactions to massage oils or aggravation of prior injuries happen to even the most experienced professional, and they can cost you big.

Why it’s a mistake: Many common massage insurance claims stem from minor incidents or circumstances out of your control.

How to avoid it: Never assume you’re immune to risk, like client slip-and-falls in your space or false claims of improper conduct, and get properly covered.

Pro Tip: Do you run your own massage spa? Get coverage for your business — and every LMT offering services — under one easy policy. Check out BBI Spa Insurance.

2. Buying Based on Price Alone

Liability insurance for massage therapists can get expensive. And when you add it to your other business expenses, like monthly rent or endless linens, the cheapest insurance policy on the market can start to look very enticing.

However, a lower price on massage insurance can mean several things:

- Fewer modalities covered

- Fewer coverage types included

- Less money (liability limits) to cover you when you need it

- Shared limits among policyholders (other people using up your coverage!)

- Service that reflects the price (like a support team you can never reach)

Why it’s a mistake: Choosing a budget insurance policy can come back to bite you when it’s time to file a claim. The coverage may not adequately cover defense costs, legal fees, or damages awarded.

How to avoid it: Consider massage therapist insurance cost as one important factor of many when choosing your carrier.

3. Not Understanding Your Policy

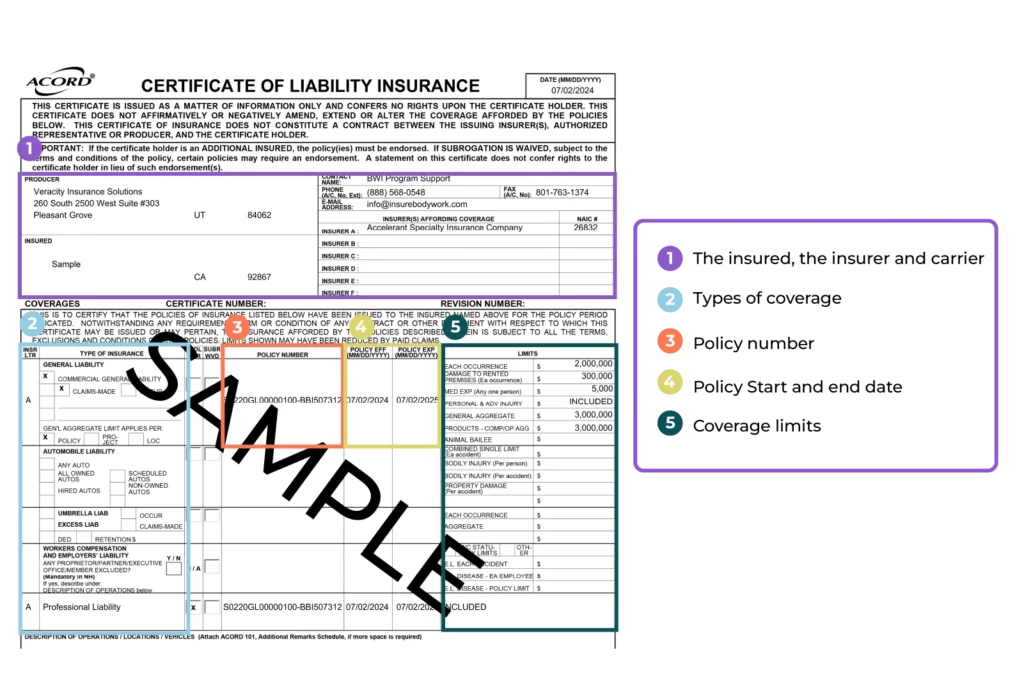

Aggregates, deductibles, endorsements — insurance can sound like another language. However, you must review your policy details thoroughly to ensure it’s the right coverage so you don’t face surprises when it’s time to file a claim.

For example, is your policy claims-made or occurrence-based? Imagine a client alleges they developed chronic pain years after receiving a massage from you.

If you have a claims-made policy, you can only file a claim if your policy is active at the time the claim is made. But with an occurrence-based policy, you’re covered as long as the service took place during the time your policy was in effect, even years later.

Why it’s a mistake: If you don’t understand your policy, you may face a surprise deductible or not be able to file a claim when you need to.

How to avoid it: Review your policy carefully, learn common insurance terms, and reach out to your insurer if you have questions about your massage insurance coverage.

4. Confusing Different Coverages

One of the most common mistakes when buying massage therapy insurance is assuming you just need one type of insurance that’ll cover you for anything and everything.

Different liability coverages protect your business from a variety of risks because, well, lots of things can go wrong. The best massage insurance policies combine general and professional liability insurance so you’re covered against the most common claims massage therapists face.

Why it’s a mistake: Mixing up professional, general, and product liability can result in gaps in protection.

How to avoid it: Make sure you understand the specific risks you face and have the corresponding coverage. Ideally, your policy will bundle the main coverages and offer optional add-ons.

Pro Tip: Do you offer fitness instruction as part of your total wellness service menu? Add coverage for yoga, dance, Pilates, or personal training with a BBI fitness trainer endorsement.

5. Forgetting to Check Exclusions

Not all insurance for massage businesses is created equal. Some policies exclude specific modalities or treatments, meaning if a client is injured during one of those excluded services, your insurance won’t cover the claim.

An insurer may exclude particular services, like cupping or hot stone massage, because they could be considered higher-risk.

Why it’s a mistake: If you overlook these exclusions and perform a service that isn’t covered, you could be held personally liable for any injuries or damages.

How to avoid it: Confirm with your insurer that all your services are covered, or if you need to add coverage for an excluded service with an endorsement.

6. Not Verifying the Insurer’s Credibility

Another common mistake is not vetting your insurer’s credibility — and their ability to pay out for a claim.

Some insurance companies look great on the surface, but may give you the run-around when you actually need help with a client slip-and-fall or property damage mishap.

Why it’s a mistake: Buying coverage from a poorly rated insurer could leave you with inadequate support, slow claims processing, or unpaid claims.

How to avoid it: Check reviews from other policyholders and look for high ratings from independent agencies like AM Best.

7. Adding Unnecessary Additional Insureds

An additional insured is a third party, like a spa owner, who is added to your policy in case a claim is made against both of you. A common massage therapy insurance mistake is adding additional insureds when it’s not required.

Why it’s a mistake: Adding unnecessary additional insureds (like a coworker or family member unrelated to your business) can increase your premium.

How to avoid it: Only add additional insureds to your policy when the party you work with explicitly requires it.

Now that you’ve been primed on common pitfalls, choose your next adventure:

➡️Learn More: Massage Insurance Guide

➡️Ready to Buy? Get Covered Now

FAQs About Common Massage Insurance Mistakes

How Do I Know if All My Massage Modalities Are Covered?

Check all your modalities against your policy’s exclusions. If anything is unclear, contact your insurer to confirm that your specific services are covered under the policy.

Is General Liability Insurance Enough for a Massage Therapist?

Nope, general liability alone isn’t enough. To properly protect your massage practice, your massage insurance coverage should include both general and professional liability insurance. Most claims in massage therapy are directly related to the service you provide, which is exactly what professional liability insurance is designed to cover.

Another important coverage to carry is sexual abuse and molestation (SAM) insurance to protect you if a client claims you’ve acted inappropriately with them.

How Much Coverage Does My Contract Require?

Always check with your landlord or employer! Many have specific requirements, such as a $2 million occurrence (claim) limit.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.