Cosmetology Insurance

Helping people feel beautiful and their best self is the center of your profession. Making sure you’re insured with the correct coverage is the center of ours. As a licensed cosmetology professional, you don’t plan on accidents happening, however, you face risks each day while on the job.

Fast & Secure Online Purchase

Buy Today & Get Immediate Coverage

Download Proof of Insurance at Checkout

$15 per Additional Insured or $30 for Unlimited

Cosmetology Insurance For Professionals

Your tools, like scissors, makeup, and nail files make your job possible, but these same tools also have the potential to harm. Whether you need mobile cosmetology insurance or coverage as an independent contractor in a salon, Beauty and Bodywork Insurance (BBI) has the coverage you need.

What Services are Covered with BBI Cosmetology Insurance?

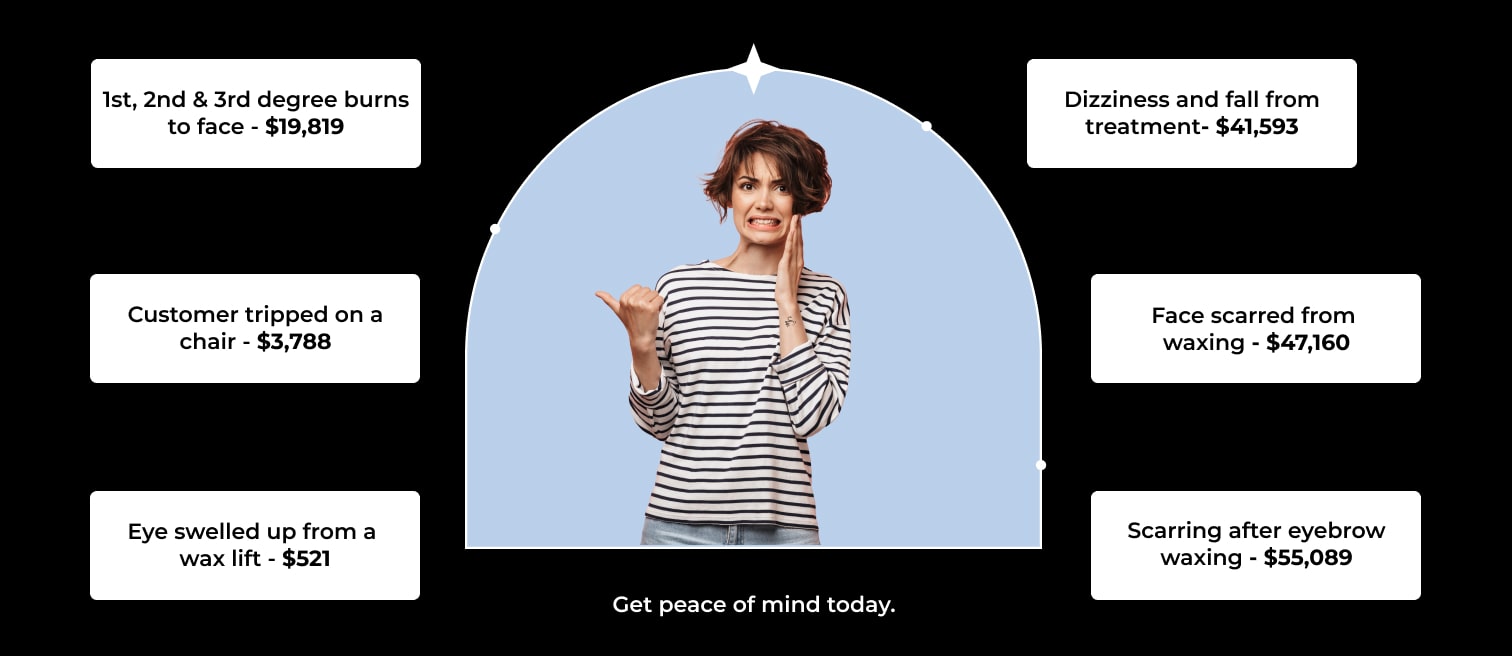

Accidents Can Cost You

You may be wondering what types of claims cosmetology insurance covers. As a professional, you do your best to avoid accidents, but they still happen. View some common claims you could face as a cosmetologist, and how much BBI can cover.

You may be wondering what types of claims cosmetology insurance covers. As an professional, you do your best to avoid accidents, but they still happen. View some common claims you could face as a cosmetologist, and how much BBI can cover.

Common Questions about Cosmetology Liability Insurance

Our certified agents are always ready to relieve stress and answer your questions about our cosmetology insurance. Here are the most common questions we get.

What is Cosmetology Insurance?

Insurance for cosmetologists is designed to protect you from the financial risks of running your businesses. It can cover everything from damages to clients’ property to injuries that occur during services. For example, your client could file a claim because they were burned or experienced a skin reaction after an appointment with you.

Cosmetology liability insurance, also known as public liability insurance, helps you protect business finances from bodily injury, property damage, and professional liability claims. At the minimum, you will want your cosmetology business insurance to include general liability, and professional liability coverage, but you should always consider covering your business personal property, too.

Why Should I Get Cosmetology Liability Insurance with BBI?

BBI provides affordable, top-notch insurance policies for professional cosmetologists. Cosmetologists can purchase a policy within a few minutes, giving you more time to assist your clients. We know how booked your days might be, so we want to ensure you’re getting insured quickly with hassle free policies. BBI allows you to select the date you would like your policy to begin and cancel your policy at any time.

BBI grants you all the flexibility you may want when it comes to your insurance for cosmetology. After you fill out your application, you will receive immediate coverage and access to your online dashboard. There’s no need to wait when it comes to BBI’s cosmetologist insurance.

With BBI, you also won’t have to join an association or pay a membership fee, like other insurance options require you to do. You only pay the annual amount for your cosmetologist liability insurance policy, without having to worry about other fees. We make this as easy as we can for you.

Why Would BBI be a good insurance provider?

Here’s a list of why BBI would be a great insurance provider for your cosmetology business:

- BBI is A+ Rated

- Our easy, online process takes less than 10 minutes to complete and you’ll receive immediate coverage and access

- We offer 24/7 access to your insurance policy with your online user account

- Filing a claim with BBI is quick and easy

- Check, edit, and make changes to your policy at any time

- You have the ability to add additional insureds to your policy at any time

- Our base policy is affordable, starting at just $96 / Year for professional cosmetologists

- Available endorsements if you need additional coverage

If you have any questions, you can chat with one of our certified insurance agents, or give them a call. We are happy to help you with what coverage is available for your specific type of cosmetology services that you provide.

Quote-Free Application Process Cosmetology Insurance

Join the tens of thousands of cosmetologists nationwide who have found peace of mind by purchasing liability coverage from BBI. Get a policy today!

Join the tens of thousands of cosmetologists nationwide who have found peace of mind by purchasing liability coverage from BBI. Get a policy today!

General and Professional Liability Limits

The most your policy will pay in a 12 month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business and professional services.

$3,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover products that are sold or distributed.

$3,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

-False Arrest, detention or imprisonment

-Malicious prosecution

-Wrongful Eviction or Wrongful Entry

-Oral or written publications that slander or libels a person or organization

-Oral or written publication or material that violates a person’s right of privacy

-The use of another’s advertising idea in your advertisement

Included

The maximum the insurance carrier will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business and professional services.

$2,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

i. Please note these are brief definitions of coverage. Your policy may be more restrictive in its language. Refer to the actual policy for a complete description of coverages and exclusions. If you would like to see a sample policy, please contact us.

Other Common Cosmetology Insurance Coverage Questions

Do I Need Cosmetology Insurance?

Yes, in a profession where you work closely and directly with clients using tools and chemicals, it is better to be safe than sorry. Getting cosmetology liability insurance will give you the peace of mind you need to focus on your job and be worry-free.

Depending on your location of practice, you may not be legally required to have liability insurance for beauty professionals. However, you assume total risk without it. There’s always the risk of allergic reactions or skin irritation when you put makeup on someone’s skin, and these risks are sometimes unavoidable. A client may not make you aware of their allergies before or during the appointment.

In addition, you could also be held liable if your products stain clothing or damage your rented space while you’re working. Protect yourself and your business from accidents. With the right cosmetology insurance, medical care, legal fees, repairs, or other claim expenses may be covered. Liability insurance for beauty professionals limits your stress while you work throughout your day.

Independently contracted or employed cosmetologists aren’t the only ones who ought to be insured. If you are a mobile or freelance cosmetologist, it’s also crucial you protect yourself from lawsuits since your personal financial assets may be at risk if you are sued.

These risks simply come with many professions, including being a professional cosmetologist.

Obviously, you practice your profession with an abundance of caution, but accidents can still happen. Even the most skilled cosmetologists have accidents – we get it. In the event of a lawsuit, you may have to pay legal costs to defend yourself even if you’re not found liable. Without insurance for cosmetologists, you may be responsible for paying all claims-related costs out-of-pocket. That’s why it’s important to protect yourself, your assets, and your wallet by purchasing cosmetology liability insurance.

What is Included in Cosmetology Liability Insurance?

Included in a standard cosmetologist insurance policy:

- General Liability Insurance

- This policy covers third-party claims of bodily injury and property damage. It can help pay for medical bills, lost wages, and other damages awarded in a lawsuit.

- Professional Liability Insurance

- This policy covers claims of professional misconduct, such as sexual harassment. It can also help protect you if you’re accused of causing physical harm to a client.

- Personal and Advertising Injury

- This coverage can help protect you if you’re accused of libel, slander, or false advertising.

- Damage to Premises Rented to You

- This coverage can help reimburse you for the cost of repairing or replacing damaged property.

- If you’re a mobile massage therapist, this coverage helps protect your while on the road.

Additionally, you can opt to include the additional coverages:

- Cupping Endorsement

- This covers claims arising from the use of cupping therapy.

- Fitness Trainer Endorsement

- This coverage is needed if you plan to include some form of fitness training such as yoga, dance, or personal training into your business operations.

- Acupuncture Endorsement

- Acupuncture is often used in massage therapy. This coverage can help protect you if acupuncture needles injure a client.

- Supplies & Tools Coverage

- Also called Inland Marine insurance. this policy covers the cost of replacing lost or damaged supplies and tools, such as massage tables and oils.

- Additional Insureds

- You may need to add additional insureds, such as your employer or the owner of the space where you work. When you add a person, event, or organization to your message therapy policy as an additional insured, they receive protection if they are named in a lawsuit due to a covered business-related loss/claim because of your actions or operations.

- Cyber Liability Insurance

- If you collect or store customer information – names, addresses, even payment information – and that information is stolen or compromised, your business could be held liable. Cyber Liability insurance can protect you from paying hefty fees, judgements, legal cost, fines, and processor fees that you become legally liable to pay.

To read about these coverage options in detail, take a look at this blog.

Buy Policy

How Much Does Liability Insurance for Beauty Professionals Cost?

Beauty professionals can purchase insurance for cosmetologists for $96 per year. This price includes $3 million in general & professional liability coverage.You are eligible to purchase this coverage as long as your services do not include any of the excluded methods listed on our site.

For just $13, we’ll provide $2000 in coverage for your tools and supplies in case of damage or theft. You can also add one additional insured for $15 or an unlimited number of additional insureds for $30.

The best part? Your application can be completed in ten minutes or less.

What Are Common Cosmetology Claims?

We know that as a trained cosmetologist, you do your best to keep your clients safe and satisfied. Unfortunately, no matter how careful you are, accidents are still bound to happen no matter how many years of experience you might hold. Here are a few common cosmetology claims that can happen:

- While installing eyelash extensions, the cosmetologist accidentally scratches a client’s eye with tweezers. You could be held liable for any harm done to your client, so make sure you always practice with care and focus on the quality of work you provide and not the quantity of clients you need to visit. Quality over quantity is a great mentality in order to avoid further accidents.

- You can also be held responsible for any harm that is caused to your client while they are on your property. If they slip and fall while at your place of business, you can be held liable for any medical bills or other expenses. This is when liability insurance for cosmetologists will come in handy.

- If a client develops an allergic reaction or a rash to makeup used on their skin, you can also be held responsible if they file a claim. In addition to protecting yourself with cosmetology insurance, it’s important to ask about existing allergies and to carry some allergy friendly options for clients.

What Cosmetology Treatments Are Covered in a BBI Policy?

When’s the Best Time to Purchase Cosmetology Insurance?

The moment you start practicing cosmetology, you are assuming all risks and you should be proactive by getting cosmetology liability insurance. As a self-employed professional, it is your responsibility to hold the liability for your business and for yourself. If you are renting space at a salon, they will most likely require you to add the salon as an additional insured to your insurance policy. With student cosmetology insurance available from BBI, you can receive coverage from the moment you begin cosmetology school.

What Is the Most Important Insurance for Cosmetologists?

Is Mobile Cosmetology Insurance Included?

If you’re planning on taking your cosmetology business on the road, BBI has you covered. A BBI cosmetology insurance policy includes mobile insurance, allowing you to take your services directly to your clients instead of working in a salon, all while having coverage. This means all of our self-employed cosmetologists will be protected anytime they go see a client.

Should I Get Cyber Liability Insurance?

If you store any client information, like names, addresses, or credit card numbers, it’s highly recommended that you purchase cyber liability insurance. This can be added on to your base policy for just $79 and provides $100,000 in coverage. Nearly 1 in 4 businesses have experienced a cybersecurity event. If a hacker accessed your clients’ personal information, it could cost you thousands of dollars and your reputation.

What Do I Need to Fill Out an Online Application?

Filling out an application is easy and only takes 10 minutes. The best part is that you don’t need to request a cosmetology insurance quote! Here is the information you’ll need to provide when filling out your application for cosmetology liability insurance:

- Your policy preferences (student, endorsements you’d like to include)

- Personal information (name, address, business information)

- Which business activities you will be performing

- Claim history

- Additional insureds (if you’d like to add any)

- Payment information

You're in good hands.

Here’s what other people have to say about their experience from over 420+ available reviews.