Insurance for Eyelash Extensions

Many people love to get their eyelashes extended because it helps them feel prettier. As a trained eyelash extension professional, you have the ability to transform the way your clients look. Unfortunately, if an accident occurred and you did not have insurance for eyelash extensions, a claim could be financially damaging.

Fast & Secure Online Purchase

Buy Today & Get Immediate Coverage

Download Proof of Insurance at Checkout

$15 per Additional Insured or $30 for Unlimited

Why Sign Up for Insurance?

Reduce Your Risk

There are risks as a beauty professional, working with the human body. There is always a chance someone might react negatively to a service or product used during an appointment. In those cases, without insurance you carry the burden of financial costs to defend yourself. Insurance coverage can help protect your assets and help give you peace of mind.

A Financial Safety Net

While you may do your best to run your business, there is always a chance of things going wrong. With coverage, you gain a financial safety net that may protect your business in the event of a lawsuit relating to your business activities. Plus, you will have peace of mind knowing that you have coverage in place and can run your business with confidence.

Get More Clients

We are the #1 trusted insurance by 63,000 Beauty Professionals. More than 30% of our insureds reported that having insurance has helped them gain clients. By getting insured, you show clients that you are a professional and can help instill confidence.

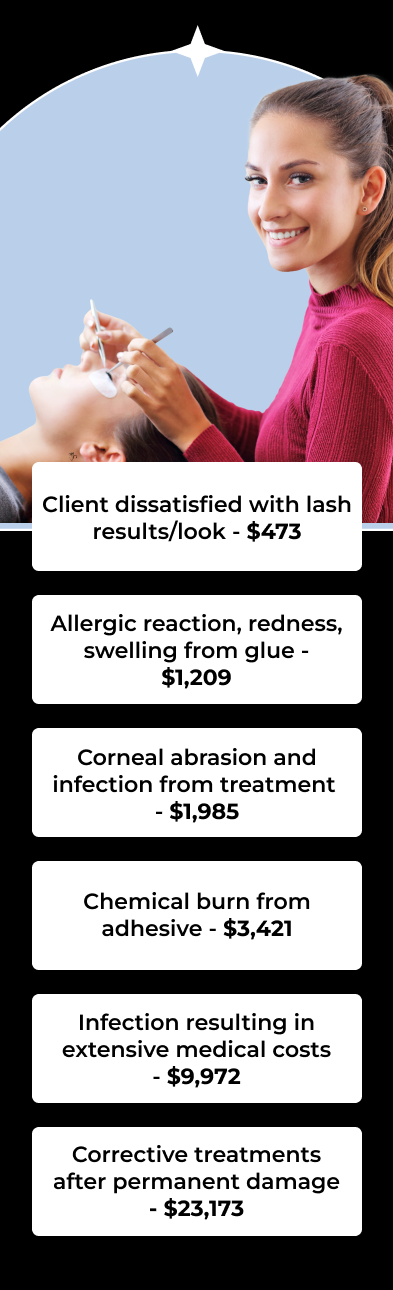

Types of Claims from Beauty and Bodywork Professionals

We get it, accidents happen. Some people get insurance because it’s required for their job. But the other benefit is it helps small businesses defend themselves from those accidents. Here are some claims beauty and bodywork professionals like yourself protected themselves from with the right coverage.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

We get it, accidents happen. Some people get insurance because it’s required for their job. But the other benefit is it helps small businesses defend themselves from those accidents. Here are some claims beauty and bodywork professionals like yourself protected themselves from with the right coverage.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

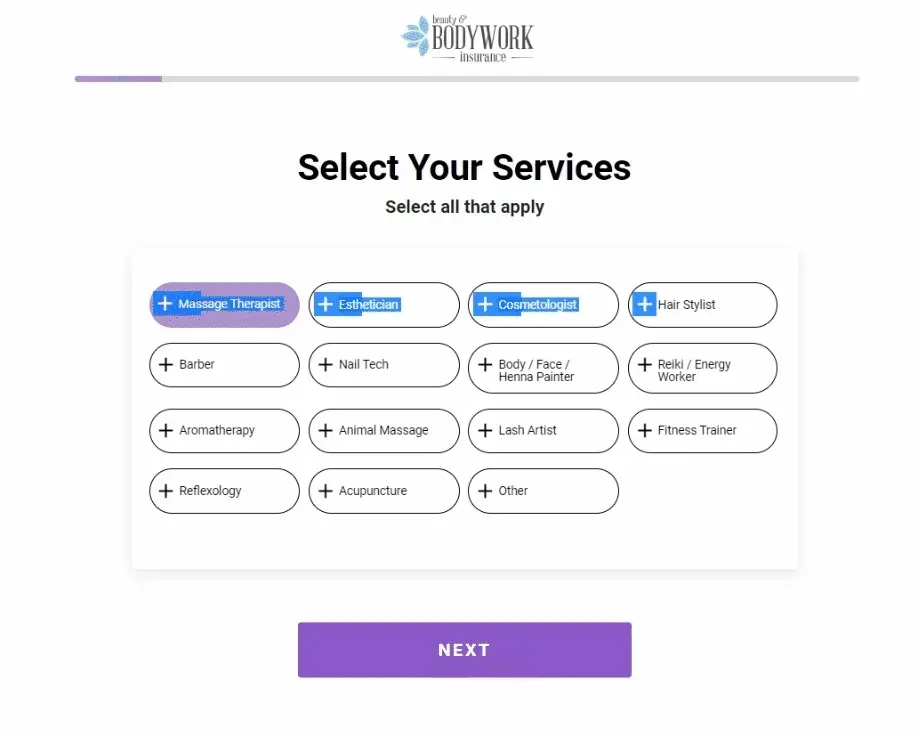

Fast, seamless coverage

We’ve revolutionized how you get Beauty and Bodywork Liability Insurance. Simply answer a few questions related to your business and the coverage you need, and get you a quote and instant coverage with a certificate of insurance in 10 minutes or less. If you don’t need the coverage to start today, you can purchase it up to 90 days before your coverage starts.

Online coverage management makes things a breeze

We think your insurance should be as flexible as your business. That’s why we’ve focused on making it easy to manage everything online. Once you purchase your policy, you’ll get access to a personalized dashboard where you can add endorsements, additional insureds, or Tools and Supplies coverage at any time.

If you ever need to cancel your policy, you can do it from your dashboard without needing to speak with a rep. But, if you need help, a rep will walk you through the process.

Claims made easy

We know you’d rather not have to file a claim. But, if you have to, you can easily file your claim online in just a few minutes through your online dashboard by simply filling out the online form with your contact information and details about the incident.

After you’ve submitted a claim, you’ll receive an email with your claim number and the Claims Adjuster’s contact information — while our team receives a copy of the loss notice.

From there, within 24–48 business hours, our team will reach out by email or phone to gather any additional information needed in order to continue with the claim. The claim then gets reviewed by the carrier, and if it’s approved, we settle the claim!

We work hard to get claims paid out as quickly as possible, this usually just depends on when the claimant is able to provide us with the information needed. If a claim is not covered, you’ll receive a letter explaining why it was not covered.

Our support team is always ready to help answer your questions. Sweater and sunglasses not always included.

Coverage Details

The most your policy will pay in a 12 month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business and professional services.

$3,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover products that are sold or distributed.

$3,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

-False Arrest, detention or imprisonment

-Malicious prosecution

-Wrongful Eviction or Wrongful Entry

-Oral or written publications that slander or libels a person or organization

-Oral or written publication or material that violates a person’s right of privacy

-The use of another’s advertising idea in your advertisement

Included

The maximum the insurance carrier will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business and professional services.

$2,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

A general liability coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy.

Any One Person: $5,000

i. Please note these are brief definitions of coverage. Your policy may be more restrictive in its language. Refer to the actual policy for a complete description of coverages and exclusions. If you would like to see a sample policy, please contact us.

You're in good hands.

Here’s what other people have to say about their experience from over 420+ available reviews.

Great comprehensive coverage that conforms to the needs of the home office, studio, atelier and business while also considering health, employees and auto. Great buy! I recommend it to everyone because it’s a very affordable insurance that can be molded to the business’ complexity or simplicity. Amazing!

Working for the first time in three years, I asked a friend about insurance, she highly recommended Beauty & Body work , it was a great site, easy to understand and lots of follow up. Im happy to be working again!

Easy peasy, I think about 6 minutes is all it took and immediately. I had my proof of insurance!

So at ease knowing I have insurance on my new Lash business and it was easy to apply.

Super fast online purchase for my esthetician business...Had a few questions before I purchased spoke with a very helpful associate that doesn't work on commission.

So happy I found Beauty & Bodywork Insurance. The process to insure my spray tanning business was seamless and affordable. Just what I needed!

Who Can Partner With Beauty & Bodywork Insurance?

Salon Suite Owners, Mobile Massage Therapists, Salon & Spa Owners, Teeth Whitening Operators, and Spray Tan Operators. Mobile Beauty Professionals. Beauty Associations. Beauty Media Companies.

Have Partnership Questions?

Partnership Associate

Jefferson Motto

About BBI

Insurance: it’s a necessity in the fabric of our modern lives. With it, we protect our financial assets, the businesses we’ve worked to build, and we rest easy at night with peace of mind knowing we are safe from potential financial ruin. Understanding this need for insurance, BBI decided to challenge the traditional methods of finding coverage. The clunky, outdated way of getting a policy through an agent took time and money away from the people who needed it the most. So in 2012, we automated the process in favor of beauty professionals.

The #1 Insurance Provider for Beauty Professionals

years of Experience

Businesses Trust BBI

Industries covered

We are proud to now serve tens of thousands of small businesses each year. Our insurance is reliable and flexible, meeting the needs of beauty professionals everywhere—including yours.

Ready to get protected?