Insurance For Salons and Spas

Insuring individual technicians, cosmetologists, or employees can be a hassle. Salon and spa insurance is one simple policy that protects up to 10 stations at once. Whether you hire employees or rent out spaces, you can have peace of mind knowing that you and all your techs are covered.

Fast and secure online purchase

Top-rated support agents

Coverage in 49 states

What is Salon and Spa Insurance?

Salon and spa insurance is coverage used to insure multiple stations (and the beauty pros who work in them) in a blanket policy. Instead of requiring each technician to buy their own liability insurance policy, salon owners can insure each of their stations. This means anyone who works in that space—such as your hair stylists, estheticians, barbers, or massage therapists—is now covered by the policy.

Insurance for salons and spas combines general and professional liability coverage into one plan. It can help pay for claims caused by you, your business, or a technician working in your space, such as:

- Third-party (clients, vendors, etc.) slips, trips, and falls

- Damage to a client's personal property

- Theft, or damage caused by third parties to inventory, tools, and supplies

- Client injuries or illnesses

- False advertising claims

- Third-party medical bills

- Legal fees and damages

This policy can cover up to 10 stations, booths, rooms, or chairs, regardless of how many technicians work there.

Note: Salon and spa owners must either rent or lease (not own) the location or property where business is conducted in order to qualify.

Instant Insurance for Salon Owners and Employees

While BBI can cover a variety of salons and spas, these are just a few examples of the most popular businesses our policy works for.

Hair Salons

Hair salon liability insurance lets you only pay for the number of stations you have, and automatically insure the stylists working at them.

Beauty Salons

Your salon may offer different services and employ many different types of cosmetologists. Beauty salon insurance covers 250+ modalities and the techs performing them.

Nail Salons and Studios

Whether your nail techs are full-time, part-time, or somewhere in between, nail salon insurance covers anyone who works at an insured station.

Barbershops

Whether they’re creating crisp line-ups or flawless fades, any barber who works at one of your barbershop’s stations will be covered.

Salon Suites

One salon suite insurance policy covers 250+ beauty and bodywork modalities, making it easy to insure most technicians renting a space in your salon.

Day Spas

From massages to facials, and manicures to waxes, spa owner insurance can insure you and all your employees at your day spa.

Franchises and Chains

If you operate a salon or spa franchise or chain, you can insure the stations in your location and the employees that occupy them.

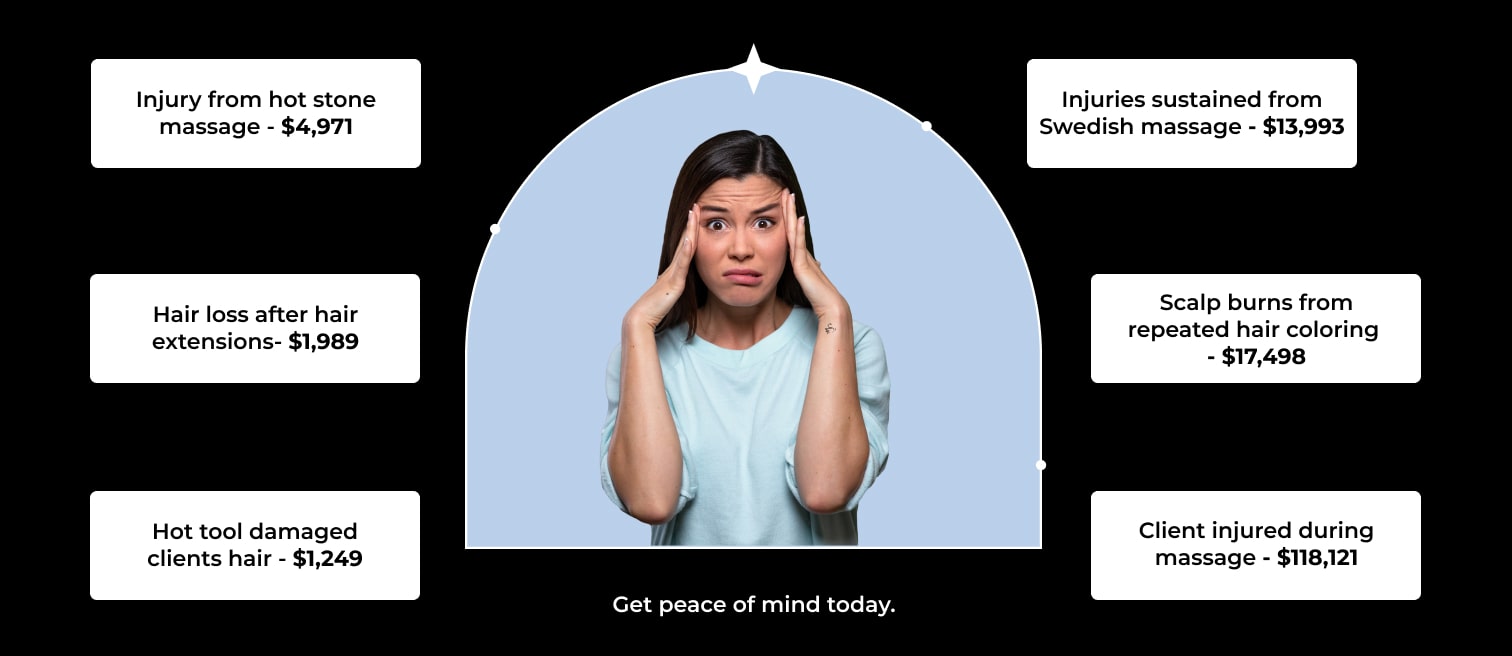

Accidents Happen, Salon Insurance Covers Them

It only takes a moment for a mistake to occur—and if it happens in your salon, you could be footing the bill for medical care or damage repairs. Salon insurance is liability protection for you and your employees. Here’s some real claim examples BBI has covered.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

It only takes a moment for a mistake to occur—and if it happens in your salon, you could be footing the bill for medical care or damage repairs. Salon insurance is liability protection for you and your employees. Here’s some real claim examples BBI has covered.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

How Much Does Salon and Spa Insurance Cost?

| Number of Stations | Premium |

| 2 Stations | $349 |

| 3 Stations | $449 |

| 4-5 Stations | $549 |

| 6-7 Stations | $575 |

| 8-9 Stations | $675 |

| 10 Stations | $775 |

Insurance Styled To Your Needs

Yearly Policy Limit: $3 million

General liability insurance protects you against third-party claims of property damage or bodily injury caused by your business operations. For example, if a client were to trip and fall in your facility and injure themselves. Professional liability insurance (aka Errors and Omissions) protects you against third-party injuries and damages caused by your business’s professional services—such as chemical burns from hair bleach or a cut from a straight razor shave you perform.

Yearly Policy Limit: $3 million

Products and completed operations coverage protects you from third-party claims of injuries or damages caused by products used during a client appointment after the service is complete. For example, a client received a facial and used retinol at home that night. Not knowing it would react with products you used on their skin earlier that day, they end up with a chemical burn. Another example could be a customer with freshly dyed hair leaving the salon and experiencing an allergic reaction resulting in scalp burns.

Included in GL

Personal and advertising injury coverage protects you if you cause physical harm or property damage to someone based on something you advertised. Let’s say you advertise on your website that your deep tissue massages help to alleviate pain from injuries, but one customer ends up with bruising and inflammation that worsens their injury. They decide to take legal action, claiming you falsely advertised your services.

Yearly Policy Limit: $300K

Damage to Premises Rented to you is a coverage for accidental property damage your business causes to a space you rent or lease. For example, you run a studio salon where you have multiple employees and contractors who offer different services at your location. One of the nail technicians has a wall display of nail polish that is knocked over. The building owner is making you pay for professional cleaning services and a fresh coat of paint.

Your tools and supplies help you give your customers the best experience. Also known as Inland Marine insurance, this coverage offers up to $2,000 for your tools and supplies in case they are damaged or stolen. This optional coverage is only $16 per year.

General and Professional Liability Limits

The most your policy will pay in a 12 month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business and professional services.

$3,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover products that are sold or distributed.

$3,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

-False Arrest, detention or imprisonment

-Malicious prosecution

-Wrongful Eviction or Wrongful Entry

-Oral or written publications that slander or libels a person or organization

-Oral or written publication or material that violates a person’s right of privacy

-The use of another’s advertising idea in your advertisement

Included

The maximum the insurance carrier will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business and professional services.

$2,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

i. Please note these are brief definitions of coverage. Your policy may be more restrictive in its language. Refer to the actual policy for a complete description of coverages and exclusions. If you would like to see a sample policy, please contact us.

Tools & Supplies Coverage

Your tools and supplies help you give your customers the best experience. Also known as Inland Marine Insurance, we offer $2,000 in coverage for your tools and supplies in case they are damaged or stolen. This optional coverage is $16 per year.

Certificate of Insurance (COI)

Instead of organizing dozens of insurance certificates from employees, you can get one Certificate of Insurance (aka proof of coverage for anyone working at one of your spa or salon’s stations). You can download the certificate immediately after purchasing a policy.

BBI vs. The Other Guys

Getting a blanket of salon and spa insurance that covers all of your technicians can be expensive. Especially when other companies want to charge you based on your income or the number of employees you have. BBI keeps it low-cost and simple: you only pay for the number of stations you want to insure.

We like doing things differently than the other guys (aka other insurance companies) because you deserve better.

Here’s what makes BBI’s Salon and Spa Insurance stand out from the crowd:

- No hidden fees or membership dues

- No shared limits with other unrelated insureds

- Same (or higher) coverage limits as competitors at a lower cost

- Insure up to 10 stations, chairs, booths, rooms, or tables

- Rates don’t increase based on revenue or employees

- Premiums are the same for every state, unlike most competitors

- Secure a policy up to 90 days in advance

- Shorter application process than competitors

- No agent required to buy insurance (and no agent fees)

- Optional monthly payments available

- Manage your policy entirely online 24/7

You're in good hands.

Here’s what other people have to say about their experience.

Great comprehensive coverage that conforms to the needs of the home office, studio, atelier and business while also considering health, employees and auto. Great buy! I recommend it to everyone because it’s a very affordable insurance that can be molded to the business’ complexity or simplicity. Amazing!

Working for the first time in three years, I asked a friend about insurance, she highly recommended Beauty & Body work , it was a great site, easy to understand and lots of follow up. Im happy to be working again!

Easy peasy, I think about 6 minutes is all it took and immediately. I had my proof of insurance!

So at ease knowing I have insurance on my new Lash business and it was easy to apply.

Super fast online purchase for my esthetician business...Had a few questions before I purchased spoke with a very helpful associate that doesn't work on commission.

So happy I found Beauty & Bodywork Insurance. The process to insure my spray tanning business was seamless and affordable. Just what I needed!

Questions About Salon and Spa Insurance

Why Would a Salon Owner Need Insurance?

Salon owners need insurance to help them cover incidents involving their salon or spa, their employees, or a customer. Even if you didn’t perform a service yourself, you assume the liabilities and responsibilities of your employees.

Let’s say a customer suffers from an allergic reaction to a chemical used during a service. They needed medical attention, and found their clothes discolored from the chemical getting on them. This customer decides to sue, naming the business, the owner, and the employee in the lawsuit. Salon owner insurance could help you pay for the legal fees, the customer’s medical bills, and any court settlements.

You may also need salon owner insurance to fulfill contract agreements. If you are operating a franchise location, the company may require you to carry your own liability policy. If you have commercial property insurance or renter’s insurance, it will cover incidents that take place on a property; only general liability insurance can cover incidents caused by your business. Accidents caused by services offered by your business can only be covered by professional liability insurance.

What Kinds of Businesses Does Salon and Spa Insurance Cover?

The BBI salon and spa insurance policy can cover a variety of salons and spas. Here are a few examples of the most common businesses our policy works for:

- Hair salons

- Beauty salons

- Nail salons and studios

- Barbershops

- Salon suites

- Day spas

- Franchises and chains

I Don’t Have Any Employees, Do I Still Need Salon And Spa Insurance?

Salon and spa owner insurance is designed for businesses who hire employees, rent rooms or stations, or contract with independent technicians. If this doesn’t sound like you, then salon owner insurance isn’t for you.

Our standard salon professional insurance for technicians starts at $96/year. You can learn more about this policy and buy coverage below. Discover Salon Professional Insurance

What Types Of Insurance Are Needed For Salons?

- General Liability Insurance This can cover injuries and damages caused by your business operations.

- Professional Liability Insurance (E&O): This can cover injuries and damages caused by the services your business offers.

- Personal & Advertising Injury: This can cover monetary damages caused to a person’s reputation or business brand not caused by bodily injury or property damage.

- Tools & Supplies Coverage: This can cover the cost to repair or replace items you use for your business if they are damaged or stolen.

- Cyber Liability Insurance<: This can cover incidents of cyber crimes brought upon your business, such as phishing scams or malware.

How Do I File A Claim With My Salon And Spa Insurance?

Accidents can be stressful, so we try to make the claims process as easy as we can. Policyholders can file a claim online at any time from their dashboard underneath the “Manage Policies” section. After 24–48 hours, you will be assigned to and contacted by your claims adjuster who will help walk you through the rest of the process. You can read more about the process here.

BBI is designed to cover common claims. Having insurance means you can have help paying for expensive claims without having to declare bankruptcy or shutting down your business. It also shows customers you are trustworthy and will handle incidents professionally, even in the event of a loss.

BBI Is Your Industry Resource

Insurance Professionals

We provide quality liability insurance for a variety of beauty and bodywork professionals, including massage therapists, nail techs, estheticians, and more. Our “A+ rated” coverage can insure you and your beauty business in 49 states (MO excluded).

Responsive Customer Service

Our team of licensed insurance agents can help you tailor a salon and spa insurance plan to fit your needs. We analyze your risks, identify gaps in your coverage, and meet most contractual insurance requirements—all for one low price.

Fast & Secure Online Quote

Apply for a free quote online at any time (no purchase necessary). Our easy and convenient online system is designed for busy salon and spa owners who need to apply outside of normal business hours. Secure a policy in just minutes today!

Affordable Premiums

BBI is one of the top insurance providers in the nation, working with trusted carriers to bring you some of the lowest annual premiums. Join the thousands of beauty and bodywork professionals who count on our low-cost coverage each year.

The #1 Trusted Insurance Provider For Beauty Professionals

Choosing the right policy for your business is important, that’s why BBI works with top insurance providers to offer A+ rated coverage. We also have a team of service agents (not sales agents) who can assist you in picking the best policy. More than 57,000 businesses have trusted in our coverage since 2011—and you can too.